Linking your Aadhaar card with your PAN card is a simple process that can be done online through the Income Tax Department’s e-filing portal. Here are the steps to follow:

- Visit the Income Tax e-filing website at https://www.incometax.gov.in/iec/foportal/

- Click on the “Link Aadhaar” option on the left-hand side of the homepage

- Enter your PAN number, Aadhaar number, name as per Aadhaar and the captcha code displayed on the page.

- Click on the “Link Aadhaar” button to proceed.

- If the details entered by you match with the details in the Aadhaar database, your Aadhaar will be successfully linked with your PAN card.

Alternatively, you can also link your Aadhaar card with your PAN card by sending an SMS to 567678 or 56161. The message format is as follows: UIDPAN<SPACE><12 digit Aadhaar><SPACE><10 digit PAN>.

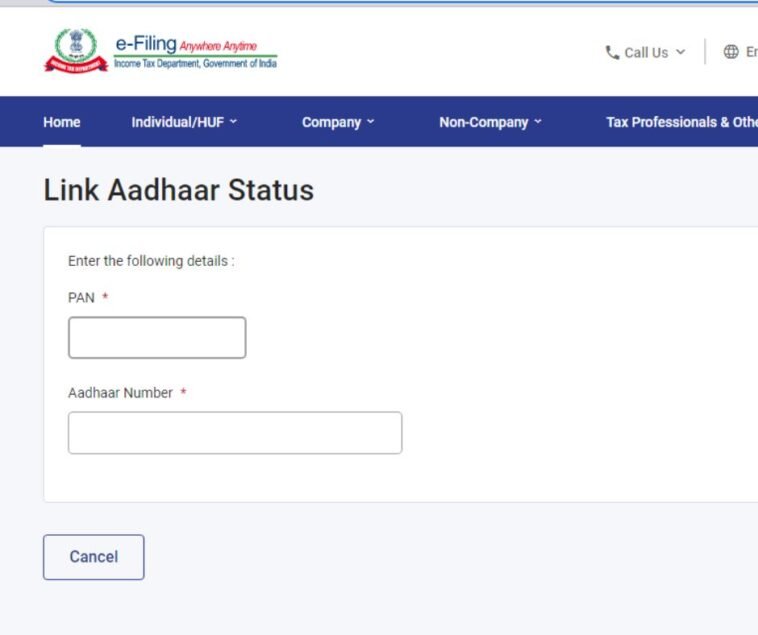

How to Check the Adhaar Card and Pan Card Link Status

To check the status of linking your PAN and Aadhaar, you can follow these steps:

- Visit the Income Tax Department’s e-filing portal at https://www.incometaxindiaefiling.gov.in/home

- Log in to your account using your PAN and password.

- Once logged in, click on the ‘Profile Settings’ tab and select ‘Link Aadhaar.’

- On the next screen, you will see the status of your Aadhaar-PAN linking.

If your Aadhaar and PAN are successfully linked, you will see a message stating ‘Your PAN is linked to Aadhaar Number XXXXXXXXXXXX.’ If not, the status will show as ‘Not Linked.’

Please Subscribe Us to get updated with Qatar News, Saudi News, Kuwait News, Health News, UAE News, Iqama, Visa, Jobs, Banking and More.. before the full time